Best Free Budgeting Software for Your Financial Planning

Managing your finances can be daunting, especially if you’re trying to balance saving, spending, and investing. Fortunately, there are tools available to help you streamline your budgeting processes. In this article, we’ll explore the best free budgeting software options that can help you take control of your financial future.

Why Use Budgeting Software?

Budgeting software can be a game changer for anyone looking to manage their finances effectively. Here are several key benefits:

- Increased Awareness: Helps you track income and expenses, giving you a clear overview of your financial situation.

- Savings Goals: Many tools allow you to set and visualize savings goals, motivating you to stick to your plans.

- Automation: Automatic transaction importing reduces the hassle of manual entry, saving you time.

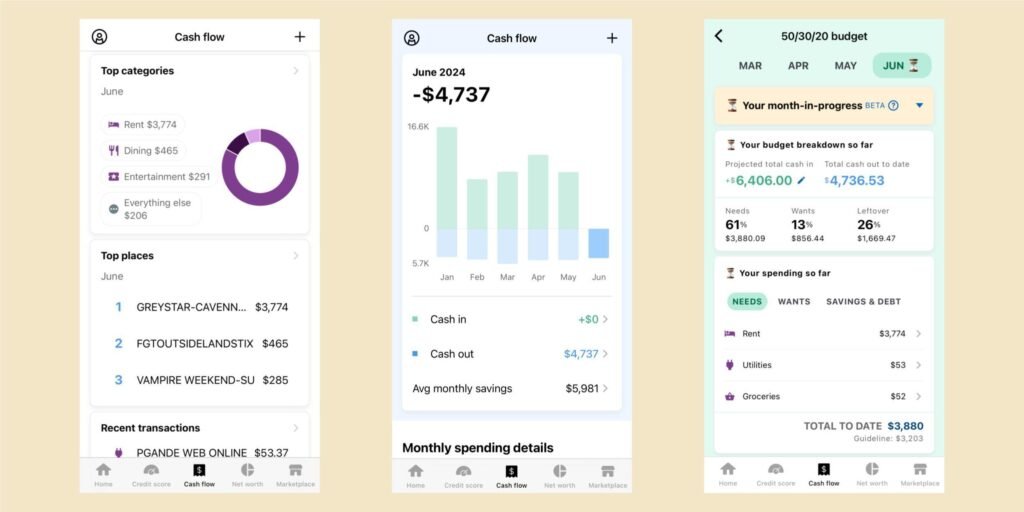

- Accessible Insights: Provides charts and reports that visualize your spending patterns.

Top Free Budgeting Software Options

Here’s a carefully curated list of the best free budgeting software available today:

| Software | Key Features | Platforms |

|---|---|---|

| Mint | Automatic categorization, goal setting, budgeting tools, credit score monitoring. | Web, iOS, Android |

| YNAB (You Need A Budget) | Zero-based budgeting, real-time data syncing, goal tracking. | Web, iOS, Android |

| Personal Capital | Investment tracking, retirement planning, expense tracker. | Web, iOS, Android |

| EveryDollar | Simple budgeting, tracking, community resources. | Web, iOS, Android |

| GoodBudget | Envelope budgeting method, mobile syncing, reporting. | Web, iOS, Android |

Practical Tips for Using Budgeting Software

- Set up your categories: Create specific spending categories to understand where your money goes.

- Regular updates: Make it a habit to update your software frequently, ideally after any significant transaction.

- Review your budget: Analyze your budget monthly to understand variances and adjust accordingly.

- Utilize notifications: Set up notifications to remind you of payments or when budgets are close to limits.

Case Study: Getting Out of Debt Using Budgeting Software

Meet Lisa, a 30-year-old teacher who struggled with credit card debt for years. After realizing she needed to change her spending habits, she started using Mint and YNAB to track her finances. Within a year, she:

- Saved $3,000 for emergencies.

- Paid off $5,000 in credit card debt.

- Developed a sustainable budgeting habit that allowed her to enjoy her salary while saving for the future.

Lisa credits the visibility and accountability provided by her budgeting software as key factors in her financial turnaround.

User Experience: My Journey with YNAB

Since I started using YNAB, my approach to budgeting has transformed. The zero-based budgeting method pushed me to allocate every dollar, whether for spending, saving, or investing. Some noteworthy changes include:

- Clarity: I now understand my priorities better, directing funds to what matters most.

- Less Stress: Knowing where my money is going diminishes monthly anxiety about bills.

- Proactive Planning: With future expenses accounted for, I’ve eliminated financial surprises.

Conclusion: Take Control of Your Financial Future

Choosing the right budgeting software can significantly impact your financial health. By adopting one of the best free budgeting software solutions mentioned in this article, you can simplify your budgeting process and become more aware and in control of your finances. Remember, the key is consistency and making budgeting a part of your daily habit. Explore these software options and find the one that fits your lifestyle best. Start today, and take the first step towards financial freedom!

Try Mint Now – Your first step towards financial clarity! Don’t miss out!