Best Budget App Free: Manage Your Finances Effectively

In an era where managing your finances is more important than ever, finding effective tools to help you keep track of your spending and savings is essential. Thankfully, there are many best budget apps that are absolutely free and can assist you in achieving your financial goals. This comprehensive guide will explore the top free budgeting apps, their features, benefits, and practical tips on making the most out of them.

Why Use a Budgeting App?

Using a budgeting app offers numerous advantages:

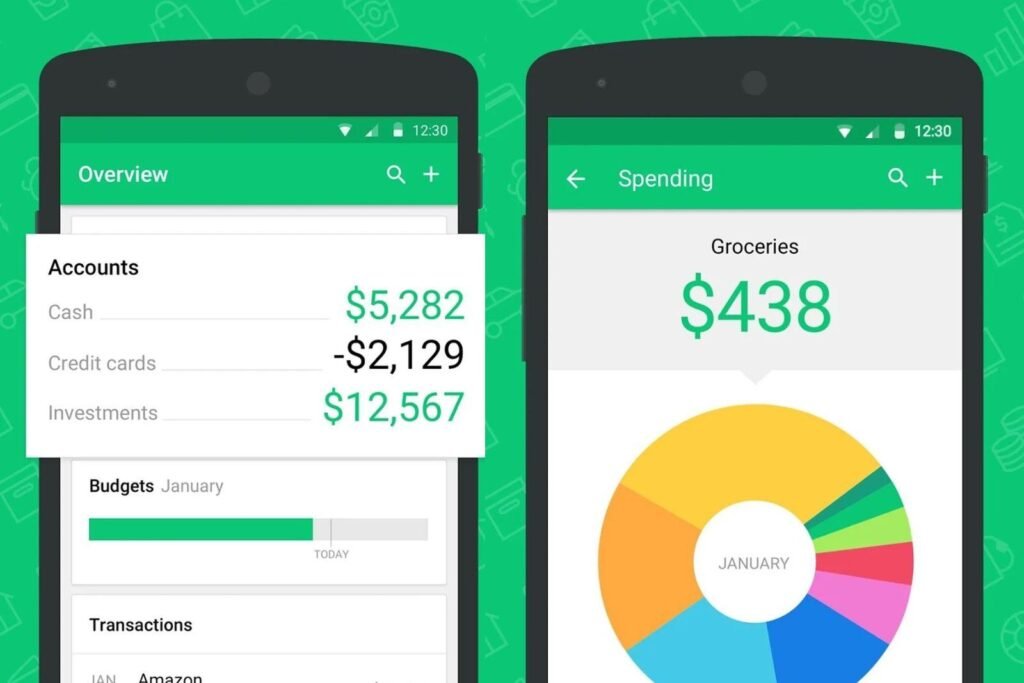

- Accessibility: Most budgeting apps are available on mobile devices, allowing you to manage your finances on-the-go.

- Real-Time Tracking: You can monitor your spending in real time, leading to more informed financial decisions.

- Goal Setting: Many apps allow you to set financial goals and track your progress towards them.

- Expense Categorization: Budgeting apps categorize your expenses, making it easier to identify spending patterns.

Top Free Budgeting Apps to Consider

| App Name | Platform | Key Features |

|---|---|---|

| You Need A Budget (YNAB) | iOS, Android, Web | Goal setting, real-time collaboration, educational resources |

| Mint | iOS, Android, Web | Automatic bank syncing, expense categorization, credit score tracking |

| EveryDollar | iOS, Android, Web | Zero-based budgeting, easy expense tracking, user-friendly interface |

| GoodBudget | iOS, Android, Web | Envelope budgeting, debt tracking, sync across devices |

| Simple | Android, iOS | Banking features, budgeting tools, picture receipts |

Detailed Review of the Best Budget Apps

You Need A Budget (YNAB)

YNAB has gained a cult following thanks to its proactive budgeting method that emphasizes planning your expenses before they happen. It offers a 34-day free trial and is particularly helpful for those who want to develop good financial habits.

Mint

Mint is one of the most popular budgeting apps available and for good reason. It automatically syncs your bank accounts, categorizes transactions, and provides insights into your spending habits. Plus, it offers free credit score tracking to keep you informed.

EveryDollar

Designed by financial guru Dave Ramsey, EveryDollar utilizes a zero-based budgeting approach, meaning every dollar you earn is assigned a specific purpose. It’s straightforward and helps create a clear financial roadmap.

GoodBudget

GoodBudget is perfect for those who prefer the envelope budgeting system, where you allocate specific amounts for different expense categories. It’s also great for couples or families wanting to manage their finances together.

Simple

Simple serves both as a budgeting app and a bank. It helps you track your spending while also offering tools for saving goals. Its unique feature allows you to take pictures of receipts for easy expense tracking.

Benefits of Using a Free Budgeting App

- Cost-Effective: With free budgeting apps, you can manage your finances without any subscription fees.

- Ease of Use: Most apps are designed with user-friendly interfaces, making it easy for anyone to start budgeting.

- Customizable: You can tailor the app to meet your specific financial needs and goals.

- Data Security: Reputable budgeting apps utilize advanced security measures to keep your financial information safe.

Practical Tips for Using Budget Apps Effectively

- Set Realistic Goals: Define what you want to achieve with your budget, whether it’s saving for a vacation or paying off debt.

- Regular Updates: Consistently update your transactions to have an accurate representation of your financial situation.

- Analyze Spending Patterns: Use your app’s reports to identify where you can cut back on unnecessary expenses.

- Engage Family or Friends: Share your budget or involve family members to promote accountability.

Case Studies: Success Stories

Many individuals have successfully turned their financial situations around by using budgeting apps. Here are two notable examples:

Case Study 1: Sarah’s Debt Elimination Journey

Sarah was overwhelmed with credit card debt. After using YNAB, she created a plan that allowed her to allocate extra funds each month towards her debt. Within two years, she fully paid off her credit cards.

Case Study 2: John’s Savings Challenge

John used Mint to find areas where he could cut back. By reducing his dining out expenses, he was able to save $5,000 in a year, allowing him to take a much-anticipated vacation.

First-Hand Experience

As a budgeting newbie, I downloaded GoodBudget to better manage my finances. The envelope budgeting concept helped me visualize my spending for specific categories like groceries and entertainment. It was easy to track my expenses and see my progress over time. After three months of using the app, I found myself spending less on eating out, which enabled me to save more effortlessly.

Conclusion

Choosing the right budgeting app can hugely impact your financial health. Whether it’s YNAB, Mint, or EveryDollar, these free budgeting apps offer tools and resources to help you manage your finances effectively. By assessing your financial situation, setting realistic goals, and regularly engaging with your chosen app, you can take control of your finances and pave the way toward a secure financial future.