Top Free Online Budgeting Tools to Manage Your Finances

In today’s fast-paced world, staying on top of your finances is crucial for achieving financial stability and security. Fortunately, several free online budgeting tools can help you keep track of your expenses, create budgets, and ultimately reach your financial goals. This article will explore some of the best free budgeting tools available, their benefits, practical usage tips, case studies, and how they can significantly enhance your financial management skills.

Why Use Free Online Budgeting Tools?

Modern budgeting tools offer a range of features that traditional methods like pen and paper simply can’t match. Here’s why you should consider using a digital budgeting tool:

- Accessibility: Access your budget anywhere with an internet connection.

- Organization: Automatically categorize and track your spending.

- Customization: Tailor your budget to fit your lifestyle and financial goals.

- Integration: Sync with your bank accounts for real-time tracking.

- Free Features: Many tools offer robust free options that can meet most users’ needs.

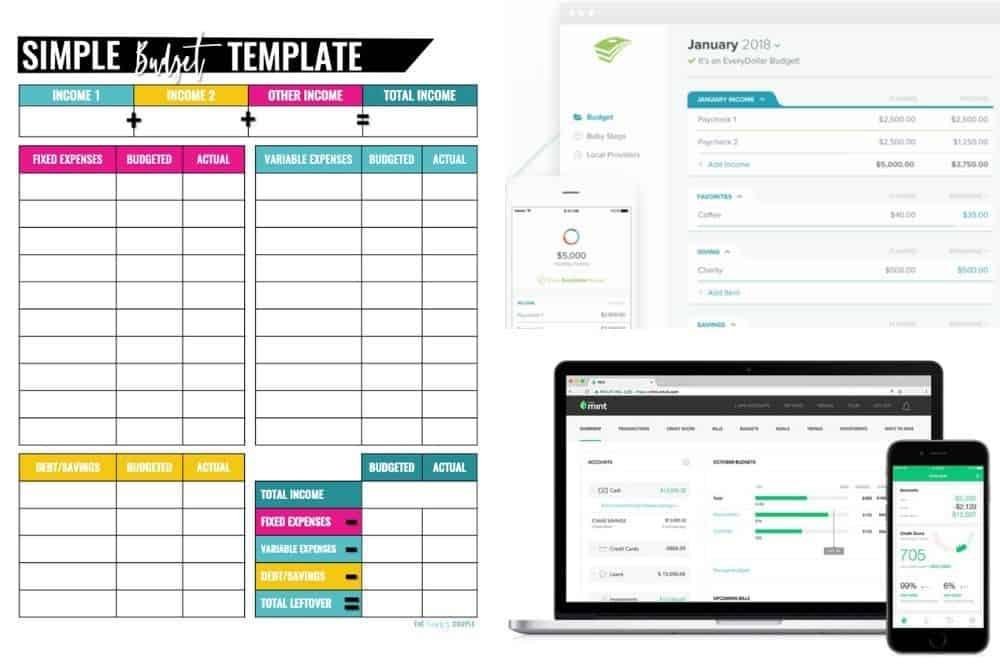

Top Free Online Budgeting Tools

Here’s a list of some of the best free online budgeting tools:

| Tool Name | Features | Best For |

|---|---|---|

| Mint | Budget tracking, bill reminders, credit score monitoring | Comprehensive budgeting |

| YNAB (You Need A Budget) | Goal setting, debt tracking, personal finance education | Proactive budgeting |

| Personal Capital | Investment tracking, asset allocation, retirement planning | Investors |

| EveryDollar | Zero-based budgeting, expense tracking, customizable categories | Simple budgeting |

| GoodBudget | Envelope budgeting system, shared budgeting, debt tracking | Families |

Benefits of Using Budgeting Tools

Using free online budgeting tools can yield numerous advantages, including:

1. Enhanced Financial Awareness

Budgeting tools enable you to visualize your spending patterns, which can help you identify areas where you may be overspending.

2. Improved Savings

Many tools allow you to set savings goals, making it easier to work towards specific financial objectives.

3. Better Financial Decision-Making

With clear insights into your income and expenses, you can make informed decisions about your finances.

4. Time-Saving Automation

Automation features can save you time by automatically tracking and categorizing your transactions.

Practical Tips for Using Budgeting Tools

To maximize the benefits of these free online budgeting tools, consider the following tips:

- Regular Monitoring: Check your budget weekly to stay accountable and make adjustments if necessary.

- Set Realistic Goals: Establish achievable financial goals to maintain motivation.

- Take Advantage of Features: Utilize all the features offered, from alerts to custom categories.

- Education: Use the resources provided by the tools to educate yourself further on budgeting and finance.

Case Study: Transforming Finances with Mint

Mary, a 32-year-old teacher, began using Mint to manage her finances after struggling with student loans and unexpected expenses. Within a few months, she was able to:

- Reduce her monthly dining expenses by 25%.

- Learn about her spending habits through categorization.

- Establish an emergency fund by reallocating savings into a dedicated account.

By regularly reviewing her budgets and adjusting her spending habits, Mary made significant progress towards becoming debt-free.

Personal Experience: Using YNAB

As a personal finance enthusiast, I turned to YNAB for its unique approach to budgeting with a zero-based method. It encouraged me to assign every dollar I earned a purpose, which transformed my attitude towards spending and saving. YNAB’s educational resources, such as workshops, helped deepen my understanding of budgeting strategies.

By using YNAB consistently, I managed to save for a family vacation while also paying down debt, showing just how effective a budgeting tool can be when used correctly.

Conclusion

Free online budgeting tools can empower you to take control of your financial future. Whether you choose Mint, YNAB, or any other budgeting software, these valuable tools provide insights, organization, and accountability that traditional budgeting methods fail to offer. Start using a budgeting tool today, and watch as your financial health improves, paving the way for a more secure and prosperous future.