Free Personal Money Management Software: Your Ultimate Guide

Managing your finances can be a daunting task. With numerous expenses, bills, and financial goals, staying on top of your money can feel overwhelming. Fortunately, free personal money management software is here to help. In this guide, we’ll delve into what personal finance software is, explore some top options, discuss their benefits, and provide practical tips to make the most out of these tools!

What Is Personal Money Management Software?

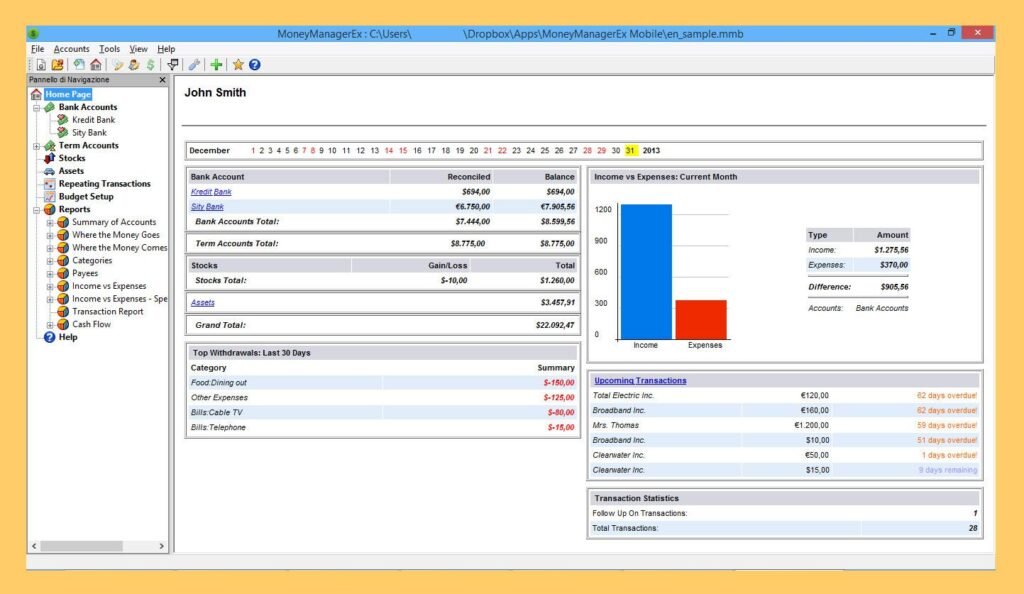

Personal money management software is tools designed to help individuals track their expenses, create budgets, and manage their overall financial health. These programs enable users to:

- Monitor and categorize spending

- Create and manage budgets

- Track income and investments

- Generate reports and insights about financial health

Top Free Personal Money Management Software Options

There are numerous free tools available to assist you in managing your personal finances. Here are some of the best options:

| Software | Key Features | Platforms |

|---|---|---|

| Mint | Budgeting, Expense Tracking, Alerts | Web, iOS, Android |

| YNAB (You Need A Budget) | Zero-Based Budgeting, Goals, Reports | Web, iOS, Android |

| Personal Capital | Investment Tracking, Budgeting, Financial Dashboard | Web, iOS, Android |

| GoodBudget | Envelope Budgeting, Expense Tracking | Web, iOS, Android |

| EveryDollar | Budgeting, Expense Tracking, Simple Interface | Web, iOS, Android |

Benefits of Using Free Personal Money Management Software

Utilizing free money management software offers various benefits, including:

- Cost Efficiency: These tools are free, which is ideal for those on a budget.

- User-Friendly Interface: Most software is designed for all skill levels, making them easy to navigate.

- Automatic Sync: Many tools connect to your bank accounts, allowing for real-time updates on your finances.

- Improved Budgeting: Helps you set realistic budgets and stick to them, preventing overspending.

- Financial Insights: Provides valuable analytics and insights into your spending habits.

Practical Tips for Using Money Management Software Effectively

To maximize the benefits of your chosen software, consider the following tips:

- Regularly Update Your Information: Keep your financial data current for accurate tracking.

- Set Clear Financial Goals: Define what you want to achieve, such as saving for a vacation or paying off debt.

- Analyze Your Spending: Review your expenses monthly to identify areas to cut back.

- Utilize Budgeting Features: Make use of budgeting tools and reports available within the software.

- Engage with Support Communities: Many software platforms have user forums or online communities where you can share tips and strategies.

Case Study: How Mint Helped One User Take Control of Their Finances

Jessica, a college student, found herself struggling to manage her finances. She had multiple subscriptions and unexpected expenses piling up. After discovering Mint, she was motivated to set up her budget and track her spendings. Within three months, she was able to save $500 by cutting down on unnecessary expenses and has since been able to save for a summer trip. Mint’s user-friendly interface and automatic syncing features made it easy for her to stay on top of her finances.

First-Hand Experience with Personal Capital

Having used Personal Capital for several months, I can personally vouch for its investment tracking capabilities. Its dashboard provides a seamless overview of my spending, savings, and investments. The software not only tracks my expenses but also analyzes my investment portfolio, helping to make informed decisions. The insights provided by Personal Capital have allowed me to improve my financial literacy significantly.

Conclusion

In today’s financial landscape, using free personal money management software has never been more critical. Tools like Mint, YNAB, and Personal Capital can streamline your budgeting process and lead you towards achieving a healthier financial future. By employing these resources, you can take control of your finances, make informed decisions, and set realistic goals. Start today and see how these free tools can transform your financial life!