“`html

Personal Home Finance Software Free: Manage Your Finances Effortlessly

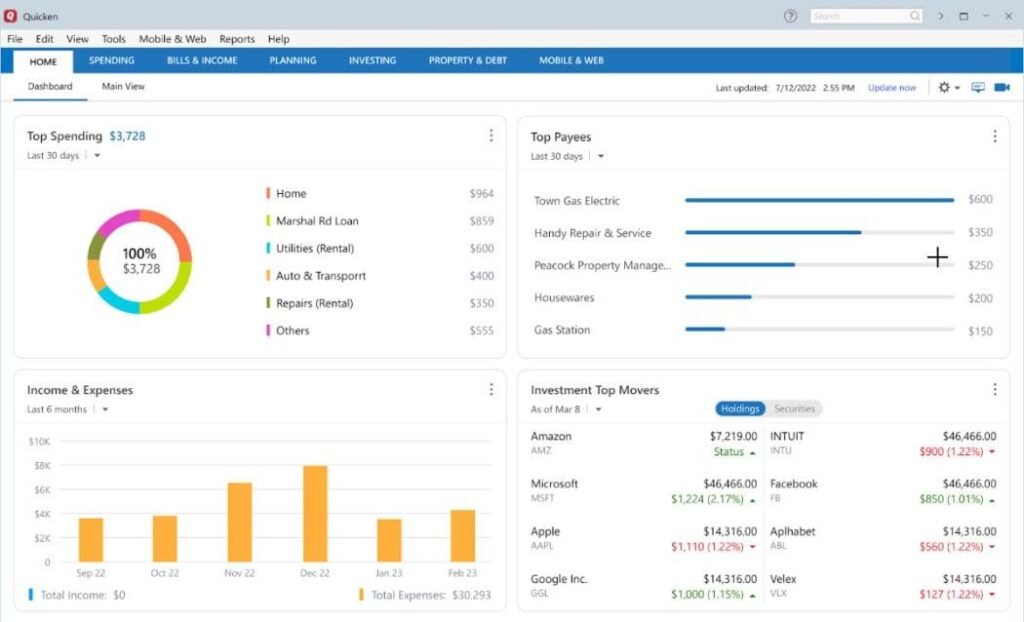

Managing personal finances can be a daunting task, but with the right tools, it can become much simpler and more efficient. In today’s digital age, various personal home finance software options are available for free. This article explores the benefits of using finance software, provides practical tips, and highlights some of the best free tools available to help you achieve your financial goals. Whether you’re budgeting, tracking expenses, or planning for the future, finding a reliable software is essential.

What is Personal Home Finance Software?

Personal home finance software is a tool designed to help individuals manage their finances more effectively. These applications can assist with budgeting, expense tracking, investing, and overall financial planning. Many options are available today, including both paid and free versions. The focus of this article will be on free options that offer robust features without the financial burden.

Benefits of Using Personal Home Finance Software

- Accessibility: Most personal finance software can be accessed on multiple devices, allowing you to manage your finances wherever you are.

- Budgeting Made Easy: Setting up a budget is simple, and the software can help you stick to it by sending reminders and tracking spending.

- Expense Tracking: Track your daily expenses seamlessly, making it easier to see where your money is going.

- Financial Insights: Generating reports and graphs can help you understand your financial health, identify trends, and make informed decisions.

- Security: Most reputable platforms offer strong security features to keep your financial information safe.

Best Free Personal Home Finance Software Options

Here are some of the most popular free personal finance software tools that you might find helpful:

| Software | Features | Platforms |

|---|---|---|

| Mint | Budgeting, expense tracking, financial goal setting, investment tracking | Web, iOS, Android |

| YNAB (You Need A Budget) | Goal tracking, budgeting, expense tracking (30-day free trial) | Web, iOS, Android |

| GoodBudget | Envelope budgeting system, expense tracking, syncing across devices | Web, iOS, Android |

| Personal Capital | Investment tracking, net worth calculator, retirement planning | Web, iOS, Android |

| ClearCheckbook | Expense tracking, budgeting, bill reminders | Web, iOS, Android |

1. Mint

Mint is among the most popular free personal finance apps available. It connects to your financial accounts to provide a complete picture of your financial health. The budgeting tool is user-friendly, making it easier to allocate your funds effectively. Plus, it provides alerts for upcoming bills and unusual transactions, adding an extra layer of security.

2. YNAB (You Need A Budget)

While YNAB isn’t free long-term, it offers a 30-day trial that gives users access to all features. Its unique approach to budgeting encourages proactive money management by assigning every dollar a job. This system helps users understand their spending habits and encourages them to think critically about upcoming expenses.

3. GoodBudget

This app uses the envelope budgeting system, allowing users to allocate funds to different categories effectively. It’s an excellent solution for people who prefer a more hands-on approach to their budgeting. GoodBudget is available on various platforms and syncs across devices, making it a flexible choice.

4. Personal Capital

If you’re looking for a tool that also emphasizes investments and retirement planning, Personal Capital is a great option. This service provides a comprehensive view of your financial life, with tools to track assets and liabilities, monitor investment performance, and calculate your net worth.

5. ClearCheckbook

ClearCheckbook focuses on tracking your expenses and helps you manage your budget with ease. It features bill reminders and reports that can help you see where you’re spending your money. The user interface is straightforward, making it beginner-friendly.

Practical Tips for Using Personal Finance Software

- Regularly Update Your Data: Ensure you enter your expenses and income regularly for the most accurate overview of your finances.

- Set Financial Goals: Use the goal-setting feature to create savings and spending goals, such as saving for a vacation or paying off debt.

- Review Your Budget Monthly: Take the time to review your budget monthly and make necessary adjustments based on your spending habits.

- Take Advantage of Reports: Use the reporting features to get insights into your spending habits and understand areas where you can cut expenses.

Case Studies: Real-Life Experiences

Many users report significant improvements in their financial lives after utilizing personal finance software. For instance, John, a freelance graphic designer, found that using Mint helped him cut down his unnecessary monthly subscriptions. By analyzing his spending habits through the app, he was able to save over $200 a month.

Similarly, Sarah, a recent college graduate, started using YNAB and was amazed at how quickly she paid off her student loans. By assigning every dollar a job, she was able to stick to her budget and prioritize her debt repayment effectively.

Conclusion

personal home finance software can drastically improve your financial management. By utilizing free tools like Mint, YNAB, GoodBudget, Personal Capital, and ClearCheckbook, you can create and stick to a budget, track your expenses, and set financial goals effortlessly. Each software has its unique features that cater to different financial needs. By taking advantage of these resources, you empower yourself to take control of your finances and make informed decisions that lead to long-term financial well-being.

Start exploring these free personal finance software options today and take the first step toward achieving your financial goals!

“`